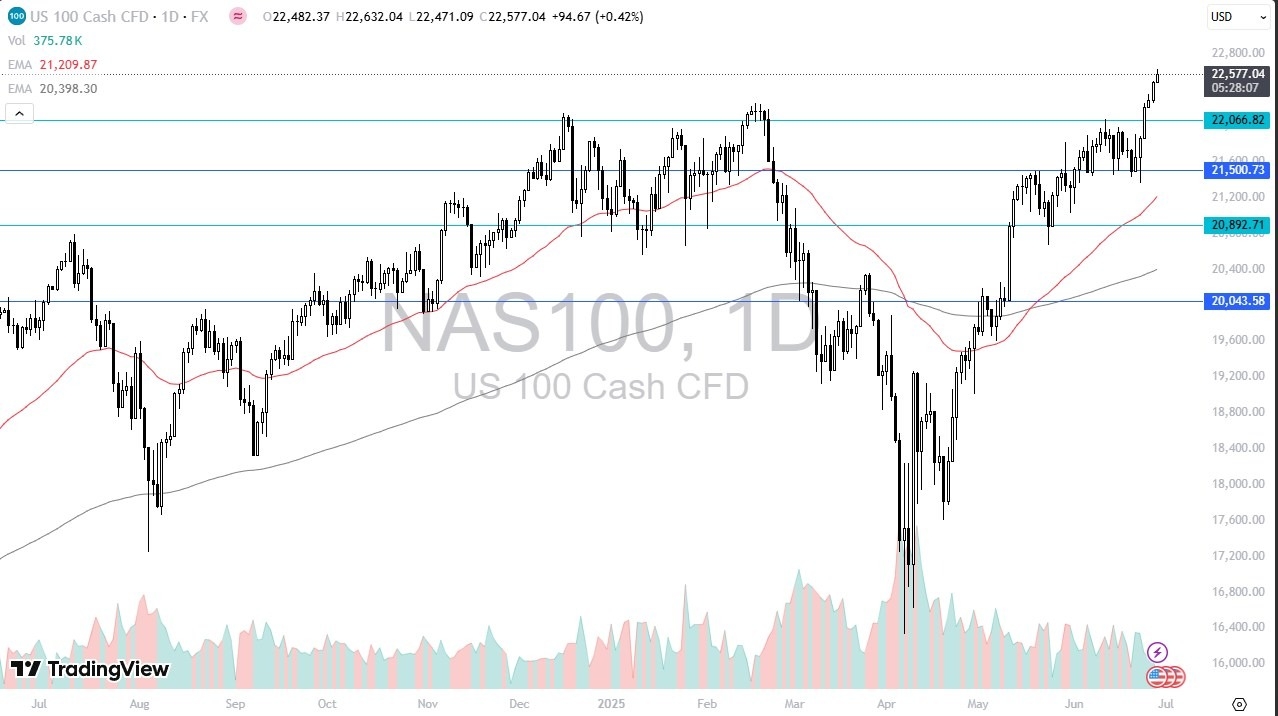

- The Friday session for the NASDAQ 100 has seen quite a bit of buying pressure again, and at this point in time I think it’s pretty obvious that the buyers are very much in control.

- We got the Core PCE Price Index numbers during the trading session on Friday, and they essentially said everything that we thought about the United States economy is true.

- Because of this, it’s one less thing to worry about, and the stock market now looks as if it is just simply chasing upward momentum.

Massive Move Higher

We have seen a massive move higher since the “tariff lows”, and it’s now news is that China is suggesting that they have a deal with the United States, and there have been comments that the European Union and the United States expect to be in an agreement between now and the July 9 trade negotiation deadline. Because of this, markets now are probably going to focus on the idea of whether or not the Federal Reserve is going to be cutting later, because the entire tariff situation is about to crumble.

Cutting rates of course leads to higher stocks eventually, but you get this weird reaction initially. On the first rate cut, Wall Street will sell off a lot of times, only to turn around and rally later. That wouldn’t surprise me, but that’s something that comes in a few months. In the short term, I just don’t see anything to keep this market from drifting higher, and if and when we get the occasional pullback, I do believe that there will be plenty of people out there willing to step in and buy this market at the slightest hint of value. After all, the NASDAQ 100 has caught a lot of people in the wrong side of the trade in both directions over the last several months, so sooner or later people were going to be looking for some type of way to recover their losses. It would not surprise me at all to see the NASDAQ 100 see a lot of support near the 22,000 level and see the 23,000 level above as a potential target.

Ready to trade our stock market forecast and analysis? Here are the best CFD stocks brokers to choose from.

Christopher Lewis has been trading Forex and has over 20 years experience in financial markets. Chris has been a regular contributor to Daily Forex since the early days of the site. He writes about Forex for several online publications, including FX Empire, Investing.com, and his own site, aptly named The Trader Guy. Chris favours technical analysis methods to identify his trades and likes to trade equity indices and commodities as well as Forex. He favours a longer-term trading style, and his trades often last for days or weeks.