As global markets gradually move beyond the inflationary aftermath of the COVID pandemic, central bankers have shifted their focus from solely controlling unusually high consumer prices to supporting economic activity toward more sustainable levels. Yet central banking has become increasingly challenging since around the start of the year. In addition to navigating the usual domestic economic dynamics at every policy meeting, central banks now face a significant external factor: the implementation of US tariffs affecting virtually every country worldwide.

Here is a summary of this week’s central banks’ interest rate decisions as well as their potential path forward:

Bank of Canada (BoC) – 2.75%

In a measured policy move, the Bank of Canada cut its key interest rate by 25 basis points to 2.75% in March. While signaling alarm over the possible economic fallout from President Donald Trump’s tariffs—described as “a new crisis” on the horizon—the BoC emphasised its need for caution. Balancing rising inflationary pressures against the drag of weaker demand, policymakers hinted that future adjustments would hinge on clarity around ongoing U.S. trade policies. In the next BoC statement, all eyes will be on how the bank addresses tariff-induced risks and Trump’s inconsistent rhetoric, as these factors continue to shape the BoC’s cautious outlook.

Upcoming Decision: April 16

Consensus: Cautious hold

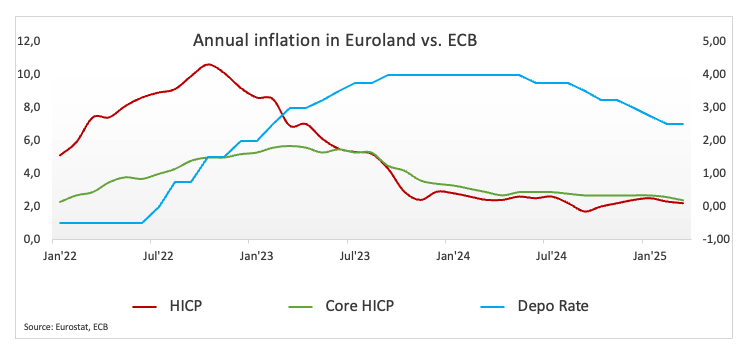

European Central Bank (ECB) – 2.50%

Marking its sixth cut since June, the ECB reduced the deposit rate to 2.50% in a bid to counter muted inflation and flagging economic growth. Notably, the bank pointed out that inflation is inching closer to its 2% target—an indication that loosening monetary policy could remain on the table. However, President Christine Lagarde struck a careful balance, declining to commit to further cuts and underscoring that both a pause or additional easing are possible. With President Trump’s tariff actions still unresolved, ECB officials remain wary of the potential damage to global and Eurozone economies. Meanwhile, the Euro’s recent strength may help inflation drift lower, possibly giving the ECB added flexibility to keep its easing measures in place.

Upcoming Decision: April 17

Consensus: 25 basis point rate cut

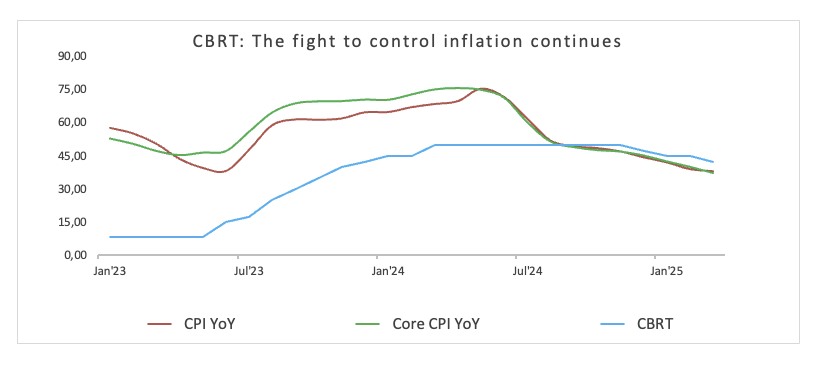

Central Bank of the Republic of Türkiye (CBRT) – 42.50%

Turkey’s central bank proceeded with a 250-basis-point rate cut in March—its third consecutive move of that size—bringing the key rate to 42.50%. This decision, largely expected by markets, extends the easing cycle initiated back in December and capitalises on the momentum of lower inflation. Headline inflation dropped to 39.05% in February, a noticeable decline from its peak of over 75% last May. Although the bank’s long-term target hovers at 5%, it acknowledges that reaching this goal will take considerable time. Monthly inflation, meanwhile, cooled to 2.27%, underscoring the likelihood of further rate reductions down the line.

Upcoming Decision: April 17

Consensus: Hold

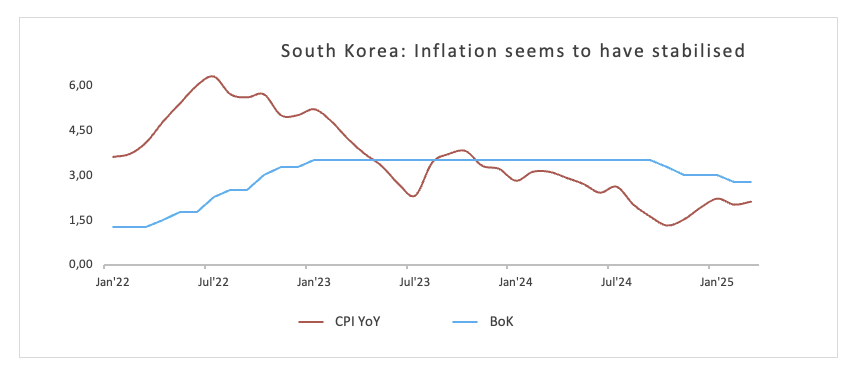

Bank of Korea (BoK) – 2.50%

In a departure from its previously tighter policy stance, the BoK surprised observers in February by cutting interest rates by 25 basis points and sharply lowering its GDP forecast to 1.5% for 2025 and 1.8% for the next year. The bank continues to expect inflation at 1.9% for both the current and coming year. This policy shift is aimed at bolstering Asia’s fourth-largest economy, which is grappling with the spillover effects of President Trump’s ongoing tariff moves and domestic political uncertainties. A weakening won has added another layer of complexity by intensifying concerns over currency volatility. Nonetheless, cooling inflation offers the bank some breathing room, allowing it to strike a balance between pro-growth policies and price stability.

Upcoming Decision: April 17

Consensus: Hold