- The Wednesday session has seen a bit of a rally in the bitcoin market, as we continue to see this market rallies significantly any time it sells off.

- That being said, we are still very much in a range at the moment, and this has a significant influence on how you need to trade in this market.

- After all, this is a market that has been bullish for a very long time, but it also needs to work off a lot of the overextension that has been part of the market for a while now.

Technical Analysis

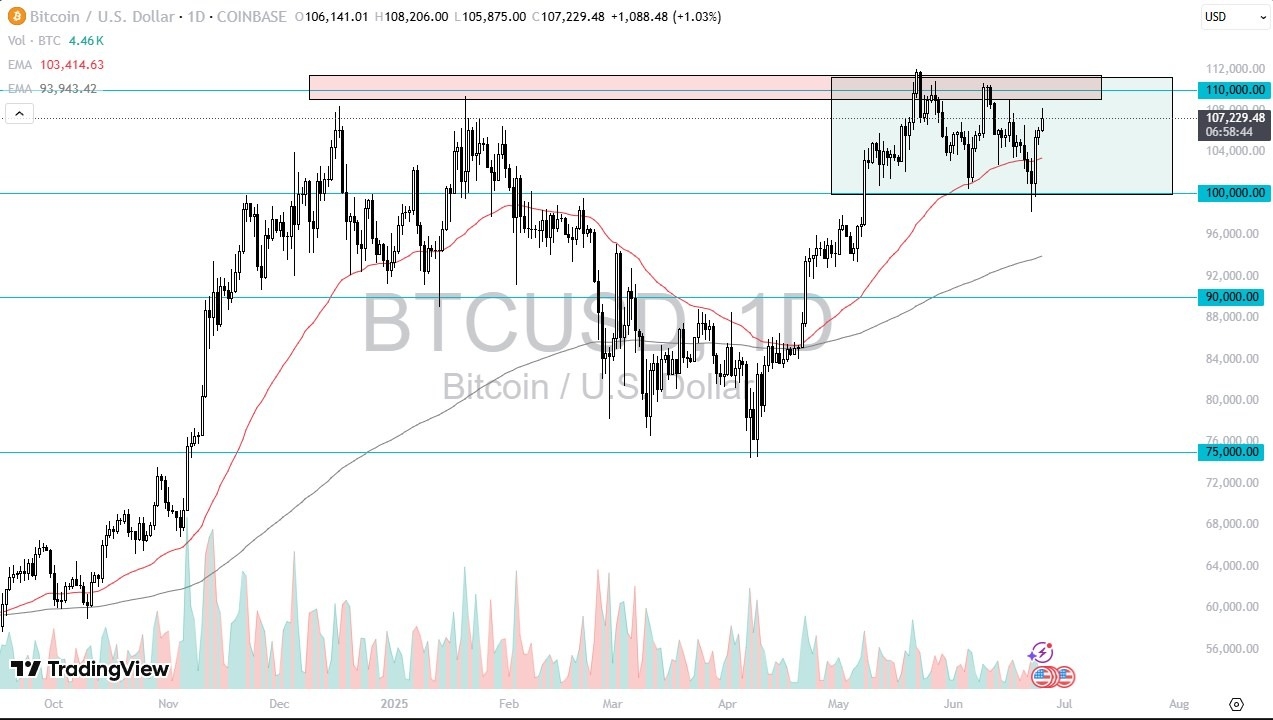

The technical analysis for bitcoin will depend greatly on your timeframe. Longer-term traders continue to look at this as a positive market, but if you are trading solely based upon the last couple of months, you may look at this more or less as a range bound market. When I look at this chart, the first thing that comes to mind is that we are working off a lot of excess buying pressure, so it does make a certain amount of sense that we would simply be a “buy on the dip” type of trader, mainly due to the fact that eventually we will break out of this range, and that typically speaking, when a market breaks out of consolidation, it tends to go in the same direction that it had been in previously.

That being said, if we were to break down below the $100,000 level, then we could see this market drop down to the $95,000 level, and perhaps even threaten the 200 Day EMA just below there. Ultimately though, I think it’s much more likely that we will break above the crucial $110,000 range, and perhaps even take out the $112,000 level, which was the recent all-time high. In that environment, I would anticipate that bitcoin could continue to the $120,000 level based on the consolidation that we have been in for a while and taking the “measured move.”

Ready to trade Bitcoin forecasts & predictions? We’ve shortlisted the best MT4 crypto brokers in the industry for you.

Christopher Lewis has been trading Forex and has over 20 years experience in financial markets. Chris has been a regular contributor to Daily Forex since the early days of the site. He writes about Forex for several online publications, including FX Empire, Investing.com, and his own site, aptly named The Trader Guy. Chris favours technical analysis methods to identify his trades and likes to trade equity indices and commodities as well as Forex. He favours a longer-term trading style, and his trades often last for days or weeks.