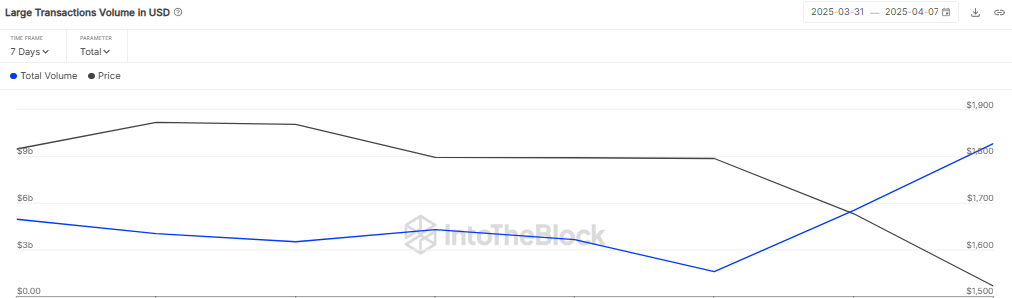

Economic tensions are still putting pressure on the crypto market. Tariffs introduced by the Trump administration have led declines in many altcoins, including Ethereum, which is currently struggling and trading in a bearish zone. Analysts predict Ethereum’s price may stay within a narrow range if these economic conditions continue. However, there is potential for a recovery soon, as large investors appear to be buying more, despite Ethereum’s recent drop below $1,500.

Ethereum’s Whale Pressure Skyrockets Over 500%

Ethereum’s price has dropped below $1,500 due to increased bearish pressure, triggered by Trump’s announcement about tariffs. This situation has caused a significant sell-off, with nearly $78.8 million worth of Ethereum being liquidated, according to data from Coinglass. Out of this, $48.1 million was from buyers and $30.6 million from sellers closing their positions. Despite these bearish conditions, Ethereum holders are remaining loyal and are not rushing to sell their holdings.

The investor who recently reactivated their wallet is still sitting on an unrealized profit of around $12.3 million, despite it having reached over $45 million at Ethereum’s peak in 2021. No sales were made then, and currently, despite a bearish market, whales are not showing a willingness to sell.

The ETH/USDT trading pair is hovering just below EMA20 trend line, which could present a significant hurdle. If it can maintain above this level, it could be beneficial for buyers, potentially driving the price toward descending resistance line. A surge above that level could send the ETH price toward $2K.

Conversely, if the price holds below the EMA20 trend line on the 1-hour chart, sellers could drive it down to around $1,300. Further bearish pressure might keep Ethereum around the $1K level.