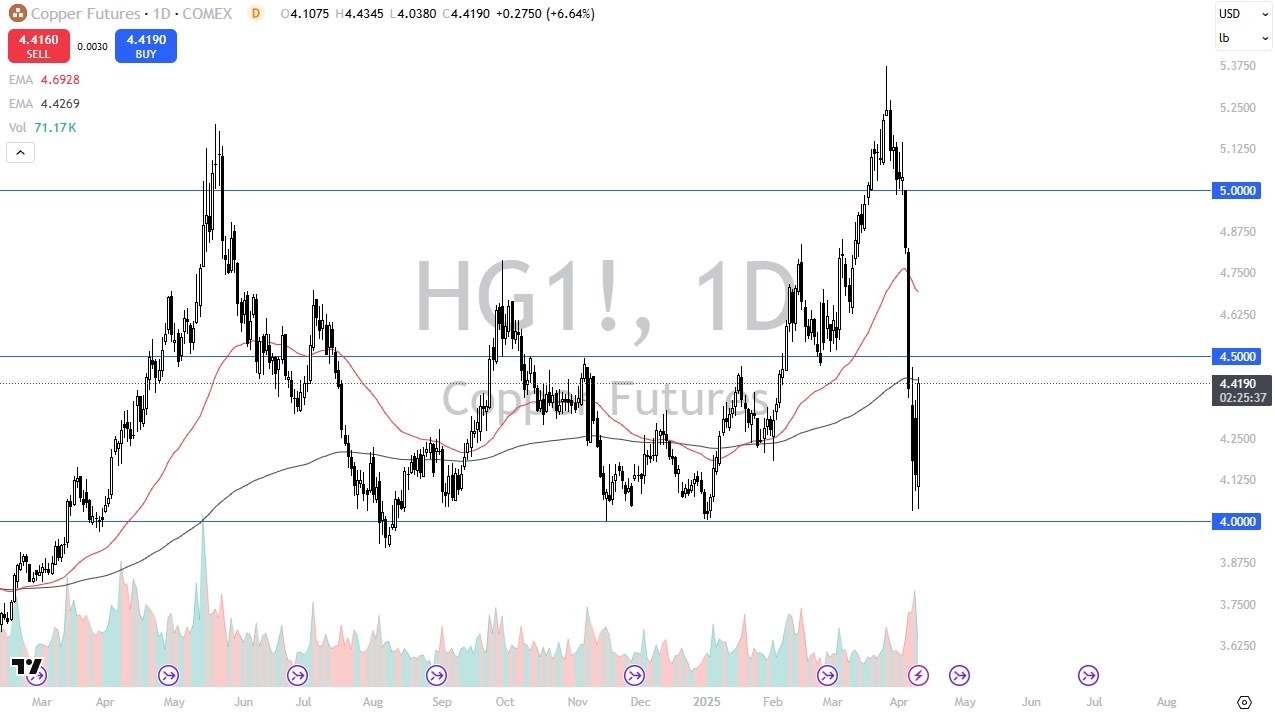

- Copper has been a wild ride during the session on Wednesday and rightfully so.

- After all, copper is highly levered to the global growth scenario.

- With Donald Trump pausing most of the tariffs during the session on Wednesday, that had short sellers scrambling.

After all, at one point there was expected to be a massive amount of tariffs on copper. And now all of sudden it’s more like a 10 % tariff, which is going to be more manageable. So, the oversold condition down near the $4 level, of course, has been starting to correct. What I find interesting in this short covering rally is that we are slowing down right around the $4.42 level, which is where the 200 day EMA currently resides.

On a Move Higher

If we can break above there, then it’s likely that copper goes looking to the $4.50 level, and anything above there could turn this whole thing around. We’ll just have to wait and see. However, keep in mind that copper is highly sensitive to China, and Trump left those tariffs on and in fact increased them to 125%. The Chinese will almost certainly react to this, so copper might be the first commodity to take a bit of heat in that environment. The $4.50 level is an area that you need to pay close attention to because it could tell us where we’re going next. I suspect that the next 24 to 36 hours will be crucial for the copper market and where it’s going longer term. Copper is highly sensitive to global growth and the idea of construction in places like China.

So, a lot of this is going to be a very fluid situation. However, this shows you just how much negativity had been soaked into the market. After all, as I record this, the NASDAQ 100 is up by about 11%. So that tells you just how out of whack the market’s got. And as soon as we got good news, everybody started covering their short positions. I think what this does, regardless, solidifies the idea of $4 being a major floor in this market.

Ready to trade our daily Forex analysis? We’ve made a list of the best forex demo accounts worth trading with.